OUR SERVICES

Economic Growth Business Incubator (E.G.B.I.) is one of the most qualified business incubators in Central Texas with almost 20 years of experience in business development and strong ties within the community to provide our clients with the resources they need to jumpstart or give traction to their small businesses.

AREAS WE SERVE

We are proud to serve our Central Texas clients in Bastrop County, Blanco County, Burnet County, Caldwell County, Hays County, Travis County, and Williamson County.

COACHING

Some of the topics we touch with our coaching clients:

-

- Business plan development

- Bookkeeping support

- Marketing assistance

- Time management training

- Tech training on useful apps

- Bidding, contracts, and certifications

- Tools to help you reach your business goals

Contact Form (Forma de Contacto)

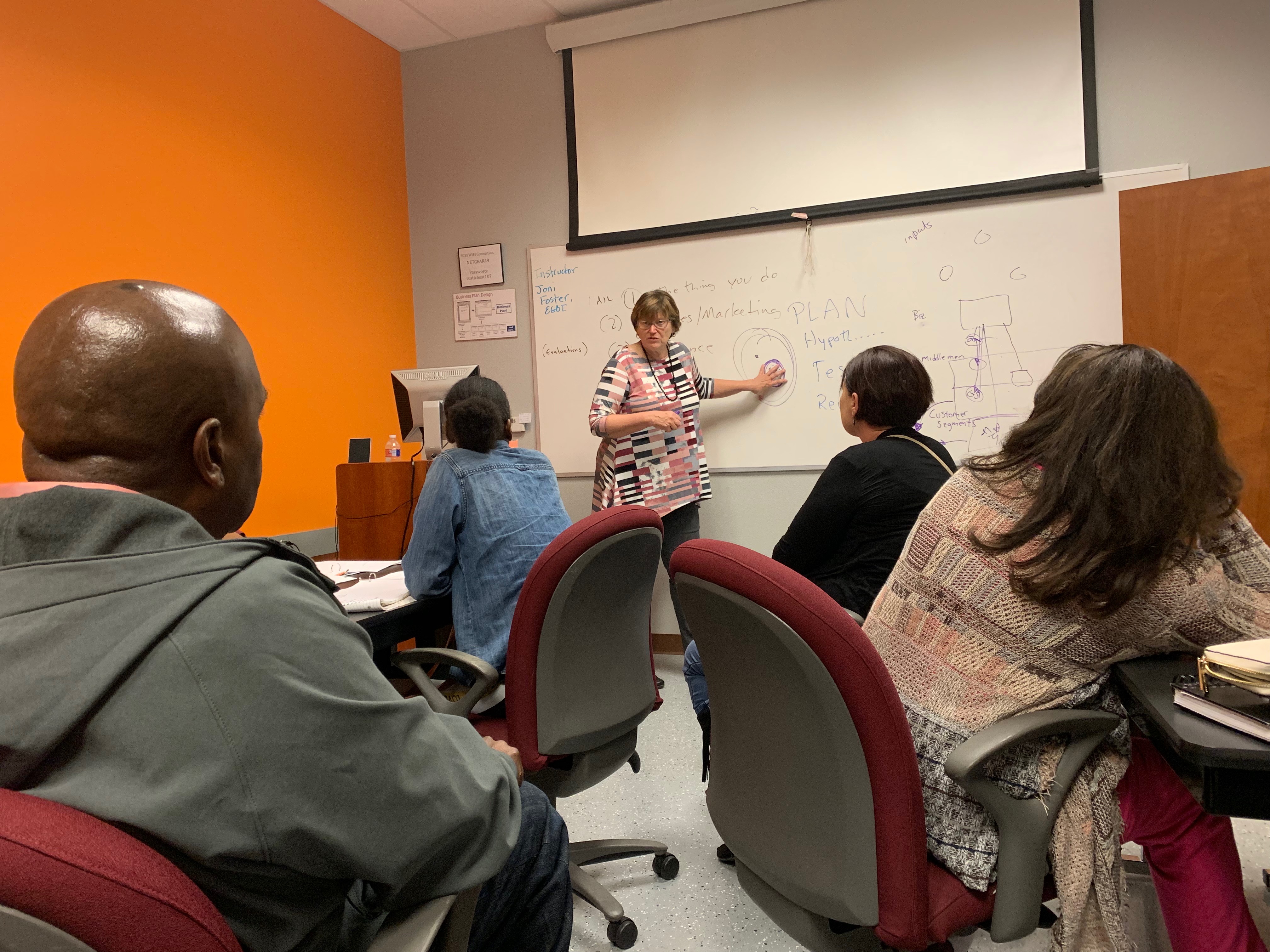

TRAINING

- How to test your Business Idea

- What is a Business Model

- To whom should you target your product/service

- How to compete strategically

- How to make your first budget and financial projections

- Setting goals

- Setting Up your Online Presence

- Financial Record Keeping

- Managing Risk/Protecting Your Business

- Marketing Tactics for Beginners

- Business Taxes Overview

- Getting into Debt: What you should know about business loans

We dedicate four months to focusing on your business and achieving the next level of success. Learn and practice a process for goal setting and accountability. Join other business owners to learn from each other and get the support you need to plow through your goals.

SUPPORT

Economic Growth Business Incubator (E.G.B.I.) offers you a range of resources to support your business. Find all the details on our support page by clicking the button below